Page 19 of 19

Re: KC metro growth and migration stats

Posted: Wed Mar 27, 2024 9:28 pm

by herrfrank

Re: states with zero income tax

I grew up in KC and paid both MO and KS (and other states) income taxes for years. Part of the complaint is the actual $$$ going out, and I really do believe that I pay less in Florida in total tax outlay than I did anywhere else I ever lived. But another part of the complaint is the extra burden of the state tax returns. The US 1040 is already a bear, and to add the Kansas and Missouri returns was always annoying to my family in the area.

My Mom moved to rural Washington 35 years ago, so she also got out of the habit of a state tax return. I think more states might do well to abolish their income tax in favor of other funding.

Re: KC metro growth and migration stats

Posted: Wed Mar 27, 2024 11:49 pm

by FangKC

State taxing policies always come down to personal situations, income levels, and whether you are working or retired.

https://www.bankrate.com/taxes/state-wi ... -or-worse/

There are winners and losers in each tax blend.

While some benefit from no state income tax, it often comes at the expense of spending on infrastructure, health care, and education.

https://www.cnbc.com/2023/07/14/these-a ... rk-in.html

https://www.sacurrent.com/news/study-te ... e-32196575

Re: KC metro growth and migration stats

Posted: Thu Mar 28, 2024 5:27 am

by earthling

Eon Blue wrote: ↑Wed Mar 27, 2024 7:33 pm

Everybody is so enamored with no income tax, like the state doesn't get your share in other ways.

There are many scenarios where paying other forms of state taxes/fees is significantly better than state income/RMD/capital gains tax. I'm in one of those scenarios, mainly with cap gains.

Re: KC metro growth and migration stats

Posted: Thu Mar 28, 2024 10:57 am

by Metro

GRID wrote: ↑Wed Mar 20, 2024 1:38 am

Good news is that despite JoCo adding the most, the MO sided continues to add over twice as many people. 8,552 MO side vs 4,009 KS side.

Not so much in the urban core though

Re: KC metro growth and migration stats

Posted: Thu Mar 28, 2024 11:38 am

by mjbauer95

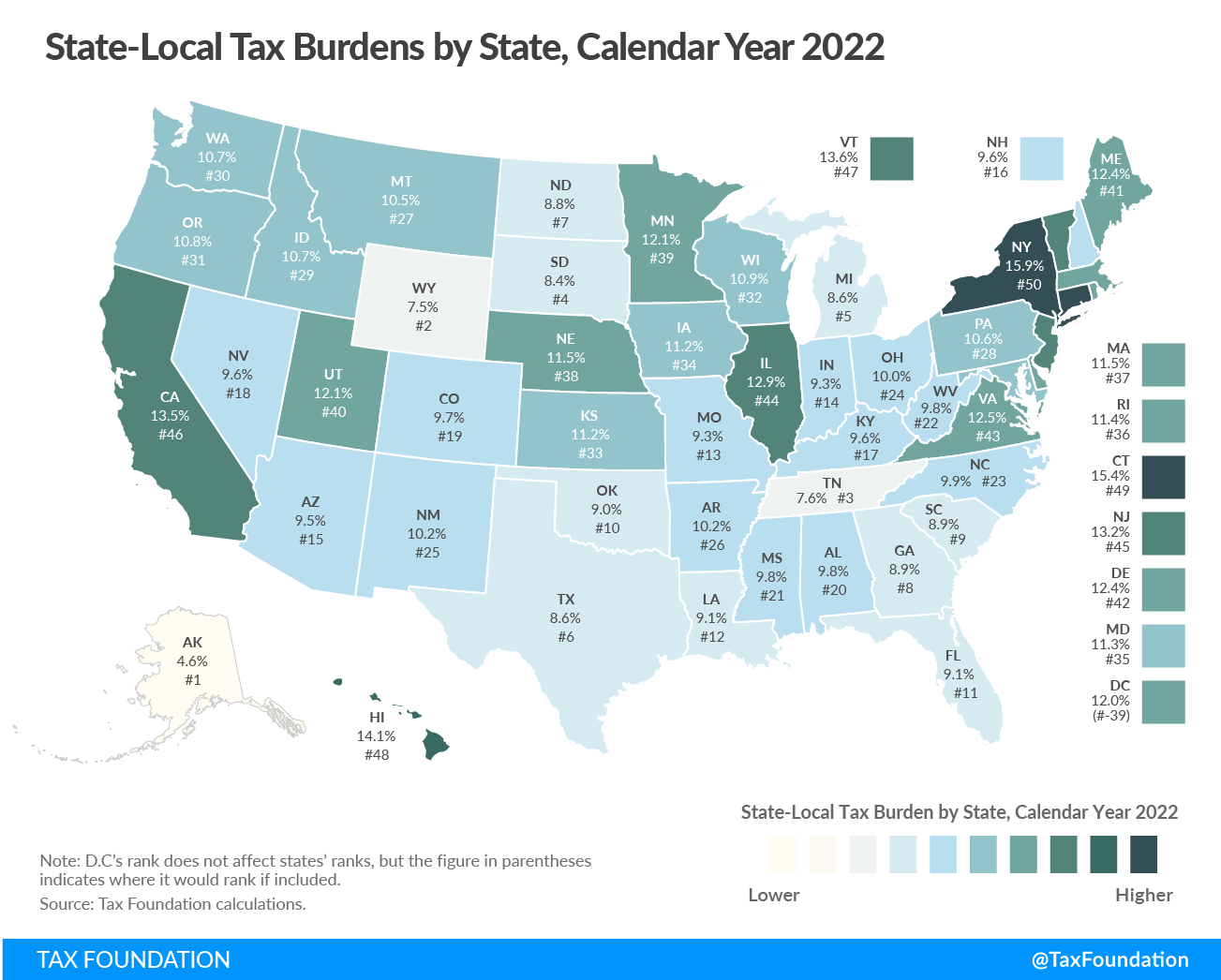

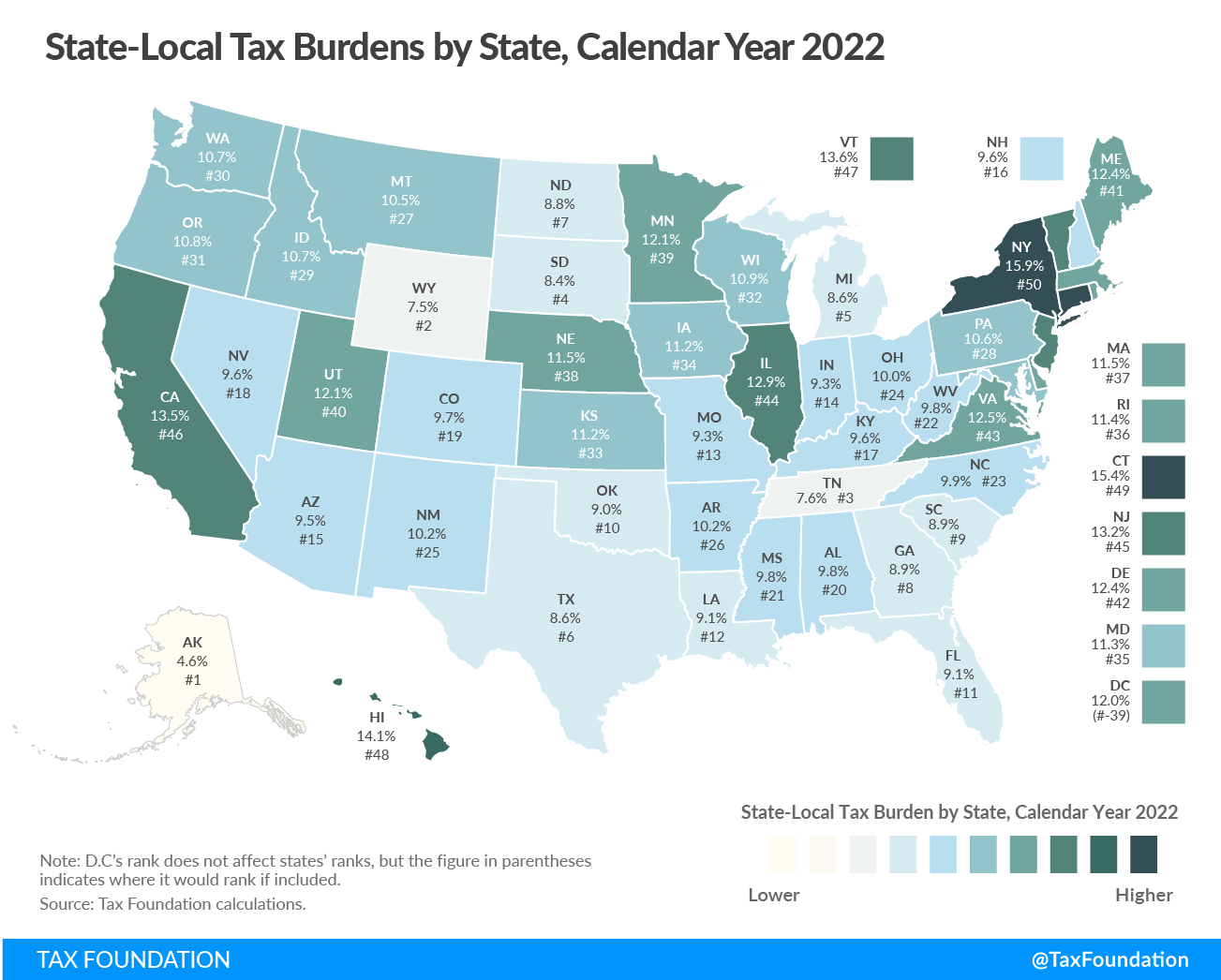

Re: taxes

Missouri actually is one of the lower states by "tax burdens" (includes property tax, income tax, sales tax, excise tax, corp tax, etc.). This is an average of the whole state I think, so can probably add 1-2% of income for KCMO. But it shows pretty competitive rates for Missouri:

Re: KC metro growth and migration stats

Posted: Thu Mar 28, 2024 4:44 pm

by herrfrank

Another variable -- the aggressiveness of the local property tax authority.

JoCo used to be fairly lax -- but since about 2000, they have been agressive with the appraisals/ valuations of properties. My family home in the area was for years appraised around 300k when it was easily worth twice that, but now, with every sale being closely watched in the neighborhood, the county sends an annual appraisal at the absolute highest comp value. The appraisal has doubled since 2015 and quadrupled since 2000. The property is worth about the same now as 2000, maybe 200k more (1.2MM versus 1.0MM) but the property taxes have increased by 5x.

Compare and contrast to Florida, where the appraisals reflect the mix of prices in the county. A full remodel does not get you re-appraised at 2x, just a slight increase from year-to-year. Many homes that sell for $2MM or $3MM are still appraised aorund 400K. They just don't agressively re-appraise down here. There are also homestead exemptions, which are not available in Kansas if you have any sort of wealth at all.

I know this is all RPP but it does underscore how expensive Kansas has become for a comfortable lifestyle.