Page 6 of 22

Re: Downtown office vacancy

Posted: Thu Jan 17, 2019 8:21 am

by KCPowercat

They have to do something about the food court.

Re: Downtown office vacancy

Posted: Thu Jan 17, 2019 8:48 am

by KC_JAYHAWK

KCPowercat wrote: ↑Thu Jan 17, 2019 8:21 am

They have to do something about the food court.

LOL...yes they do. There are probably 4 open spots, with the Tex-Mex joint taking up 2 spots for some odd reason. I miss the old McDonalds that was in there.

Re: Downtown office vacancy

Posted: Thu Jan 17, 2019 9:34 am

by KCPowercat

The Tex Mex place opens the second location "wrap it up west" if you will...when it's really busy.

At one point there was a plan to turn all the food court places into street entrances...at least the ones where it was possible elevation wise.

They should just turn the food court level (minus Jason's and Starbucks and dominos) into the fitness center and move food into the fitness center and barber shop locations

Re: Downtown office vacancy

Posted: Thu Jan 17, 2019 11:14 am

by KCtoBrooklyn

normalthings wrote: ↑Wed Jan 16, 2019 7:10 pm

My napkin math shows that the purchase and lease up to 85% of City Center Square will push the downtown class a vacancy down to around 9%

It was unclear to me whether the 85% occupancy rate cited in the article was referring to City Center Square or the Populous building. My initial thought was the latter.

Re: Downtown office vacancy

Posted: Thu Jan 17, 2019 2:01 pm

by FangKC

Although Somera isn't ready to reveal specifics, it does plan to upgrade the 30-story, 663,656-square-foot office tower, spokeswoman Hope Wheeler told the Kansas City Business Journal.

Located at 1100 Main St., City Center Square includes tenants such as the Kansas City Business Journal, Alight Analytics, Pinsight Media and Cooling & Herbers PC. There's also a fitness center, post office and a variety of restaurants on the first floor. The occupancy rate is 50 percent.

This isn't Somera's first foray into Kansas City. In 2016, it bought a four-story office building at 300 Wyandotte St., which previously housed Populous' headquarters. It rebranded the River Market building as 3Y and embarked on about $5 million in improvements, including additional parking spaces for tenants, a new rooftop space and gathering area, updated lobby and streetscape, and a B-cycle bike-share station.

Somera has secured multiple long-term tenant leases and is negotiating a lease that would bring the building to nearly 85 percent occupancy, Wheeler said.

Re: Downtown office vacancy

Posted: Thu Jan 17, 2019 3:19 pm

by normalthings

FangKC wrote: ↑Thu Jan 17, 2019 2:01 pm

Although Somera isn't ready to reveal specifics, it does plan to upgrade the 30-story, 663,656-square-foot office tower, spokeswoman Hope Wheeler told the Kansas City Business Journal.

Located at 1100 Main St., City Center Square includes tenants such as the Kansas City Business Journal, Alight Analytics, Pinsight Media and Cooling & Herbers PC. There's also a fitness center, post office and a variety of restaurants on the first floor. The occupancy rate is 50 percent.

This isn't Somera's first foray into Kansas City. In 2016, it bought a four-story office building at 300 Wyandotte St., which previously housed Populous' headquarters. It rebranded the River Market building as 3Y and embarked on about $5 million in improvements, including additional parking spaces for tenants, a new rooftop space and gathering area, updated lobby and streetscape, and a B-cycle bike-share station.

Somera has secured multiple long-term tenant leases and is negotiating a lease that would bring the building to nearly 85 percent occupancy, Wheeler said.

The end of the article(I think?) mentions that the building(Somera) has potential clients lined up that would boost the rate to 85%.

Re: Downtown office vacancy

Posted: Tue Jan 29, 2019 7:51 pm

by KCDowntown

Latest BizJournal article about City Center Square's purchase specifically mentions plans to improve the street-level around this building.

KCDowntown

Re: Downtown office vacancy

Posted: Tue Jan 29, 2019 9:24 pm

by missingkc

BizJournal:

The renovation will include a “state-of-the-art fitness center and tenant lounge, numerous in-house dining options, a fully-activated lobby, a hospitality center, a conferencing center and a revival of the property’s iconic lightwell,” the HFF release said. “Furthermore, Somera Road intends to activate the exterior with retail terraces and public seating.”

Re: Downtown office vacancy

Posted: Wed Jan 30, 2019 8:40 pm

by FangKC

City Center Square's new owners secure $60M for renovations

https://www.bizjournals.com/kansascity/ ... j=86359641

Re: Downtown office vacancy

Posted: Mon Apr 29, 2019 2:43 pm

by earthling

CBRE says Q1/2019 Downtown office vacancy is at 16% and Class A improved to 12.8%.

http://cbre.vo.llnwd.net/grgservices/se ... 69386fdc4d

Colliers tracks a lot more space (broader types of buildings). They haven't released Q1/2019 yet but Q4/2018 says downtown vacancy at 8.1% with Class A at 12.1%...

https://www2.colliers.com/en/Research/K ... s-Colliers

12% vacancy is the traditional indicator to spawn speculative construction, so not surprising to see a couple happening - though not particularly large ones.

Re: Downtown office vacancy

Posted: Tue Sep 17, 2019 9:49 am

by earthling

Q2/2019 office reports...

Colliers: Downtown Class A vacancy improves a bit to 11.4%, total vacancy only 7.6%...

https://www2.colliers.com/en/Research/K ... ice-Trends

CBRE: Downtown Class A 13.2%, they don't track as many buildings as Colliers.

https://www.cbre.us/research-and-report ... w-Q2-20190

Re: Downtown office vacancy

Posted: Tue Sep 17, 2019 12:11 pm

by earthling

Both claim nearly 1M sqft Class A available, but apparently no blocks more than 200K-300K in same building?

Re: Downtown office vacancy

Posted: Tue Oct 08, 2019 6:34 pm

by earthling

CBRE Q3/2019 Office Report...

Downtown Class A had negative absorption and vacancy went up, but so did the amount of A office space.

https://www.cbre.us/research-and-report ... ew-Q3-2019

Re: Downtown office vacancy

Posted: Tue Oct 08, 2019 6:43 pm

by earthling

And here's another source I haven't ever posted, Cushman Wakefield. They don't track quite as much office space...

http://www.cushmanwakefield.com/en/rese ... e-snapshot

Re: Downtown office vacancy

Posted: Mon Dec 30, 2019 7:37 pm

by earthling

It felt like KC has been taking off with "flexible" office space (like WeWork and Plexpod) recently and sure enough it has been. Standing out nationally in % of overall leasing.

https://www.cbre.us/research-and-report ... es-Q3-2019

https://www.cbre.us/research-and-report ... es-Q3-2019

Re: Downtown office vacancy

Posted: Wed Feb 19, 2020 2:20 pm

by earthling

Details on KC's rapid growth of flex space (co-working space like WeWork)....

Re: Downtown office vacancy

Posted: Thu Feb 20, 2020 10:47 am

by earthling

Zimmer, yet another source for office market. Claims downtown Class A only 10% though had negative absorption. But they don't track quite as many buildings as Colliers.

https://ngzimmer.com/research-center/ka ... et-reports

Re: Downtown office vacancy

Posted: Sat Jun 06, 2020 5:34 pm

by normalthings

Colliers reports KC market in Q1 has seen a 5% increase in rents, no change in the vacancy rate, and absorbed space. Downtown class A vacancy rate now 10%.

Cushman Wakefield has downtown at 12.5% vacancy

Re: Downtown office vacancy

Posted: Sat Jul 11, 2020 6:39 am

by earthling

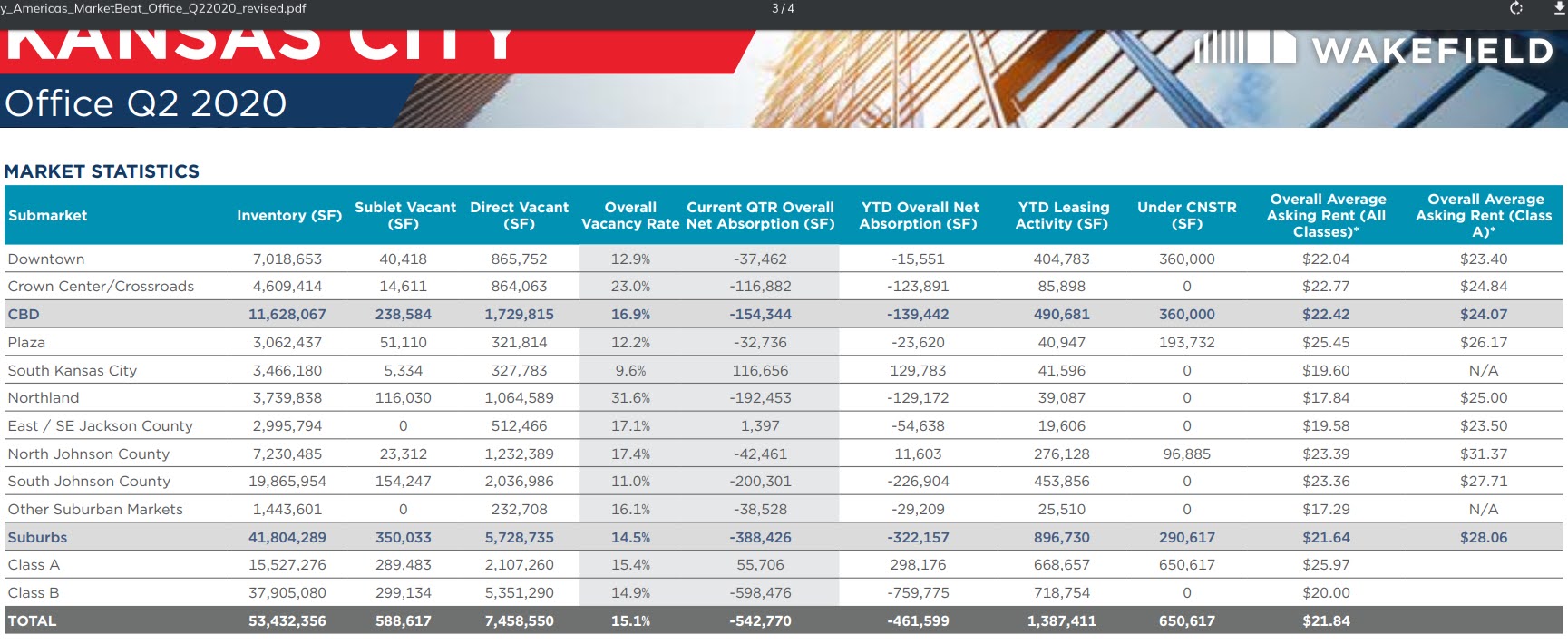

Q2/2020 Office Report from Cushman Wakefield, which does not track as much space as Colliers.

There were some new leases/renewals in metro but more than offset by over 500K negative net absorption. Northland and S JoCo took hardest hits as well as Crown Center in the city. Greater Downtown vacancy jumped to nearly 17% from 12.5% last Q, a bit higher vacancy than metro avg. Colliers tracks the most space, their report should come out later in month.

This could get worse long term across US if Work From Home becomes more permanent with more companies.

https://www.cushmanwakefield.com/en/uni ... arketbeats

https://www.cushmanwakefield.com/en/uni ... arketbeats

Re: Downtown office vacancy

Posted: Sat Jul 11, 2020 6:59 am

by earthling

Q2 Office Report from CBRE, which tracks a bit less metro space than Cushman Wakefield and much less than Colliers.

https://www.cbre.us/research-and-report ... ew-Q2-2020

https://www.cbre.us/research-and-report ... ew-Q2-2020