Exactly, and don't need excessive pricey office space for back office workers if most are WFH. Yet they can come in once in a while with a nicer Class A upgrade, best of both worlds, great recruiting perk. Fewer parking spaces needed too relative to total # of employees given many would be rotated in, some maybe rarely.normalthings wrote: ↑Thu Jan 14, 2021 6:20 pmIf you cut your space requirement, you can spring for much nicer locations & buildings. I see it eventually happening in NYC and San Fransisco.earthling wrote: ↑Thu Jan 14, 2021 6:08 pm ^One possible positive trend that might happen for downtown even if overall office demand shrinks...

As leases expire over time, for some companies needing less space due to relatively more WFH employees, they may upgrade to less space in a newer/upgraded Class A building (or WeWork type flex conversions). At least those willing to move. That might allow for new Class A construction, maybe, however potentially a decrease in overall space as some Class B/C buildings convert to residential. Just a possible scenario, not implying likely.

Downtown office vacancy

-

earthling

- Mark Twain Tower

- Posts: 8519

- Joined: Sun Sep 11, 2011 2:27 pm

- Location: milky way, orion arm

Re: Downtown office vacancy

-

earthling

- Mark Twain Tower

- Posts: 8519

- Joined: Sun Sep 11, 2011 2:27 pm

- Location: milky way, orion arm

Re: Downtown office vacancy

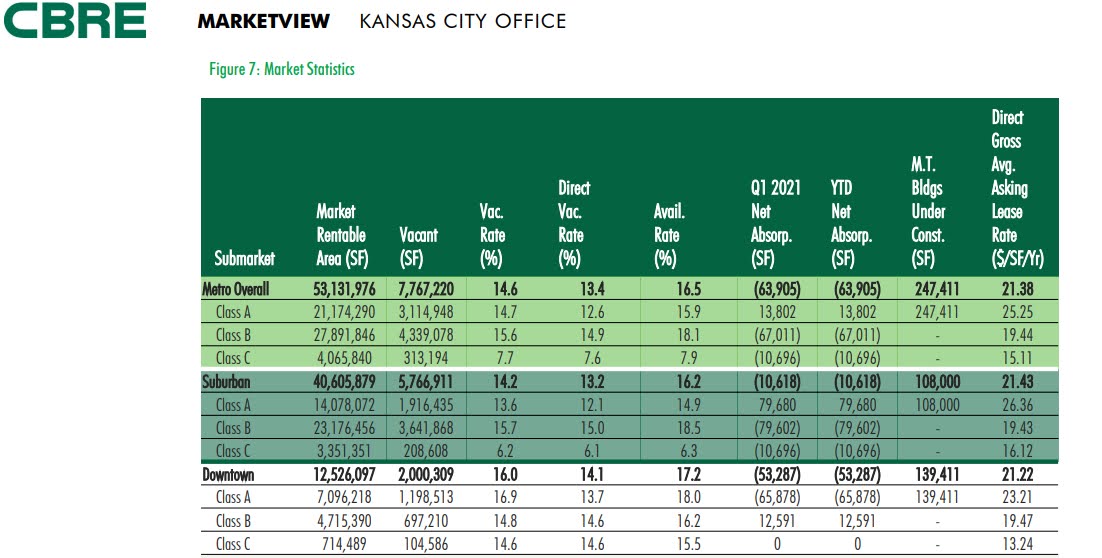

Here is CBRE's Q4/2020 report. They claim for the year downtown net absorption was down only about 3.6Ksqft compared to Cushman claiming down 233Ksqft.earthling wrote: ↑Wed Jan 13, 2021 7:47 am Cushman Wakefield Q4/2020 report is out, which does not track the most space (Colliers does). Greater Downtown had negative 233K sqft absorption for the year, vacancy increasing to 17.7%. Metro nearly had 1M negative absorption, vacancy increasing to 16.4%. South JoCo took the biggest hit.

https://cw-gbl-gws-prod.azureedge.net/- ... cc6ecaa661

Outlook

• Expectations for leasing activity and absorption in the first half of 2021 remain modest as businesses emerge from the pandemic.

• Tenants looking to adjust traditional in-office hours for employees may look to slightly shrink their footprint, but will demand higher quality, more flexible spaces.

• As speculative space delivers, the overall Class A asking rate will rise although legacy Class A buildings will be unlikely to demand an increase.

http://cbre.vo.llnwd.net/grgservices/se ... e714e1d633

They track different classes/types of buildings, so not too surprising there's such a difference.

-

earthling

- Mark Twain Tower

- Posts: 8519

- Joined: Sun Sep 11, 2011 2:27 pm

- Location: milky way, orion arm

Re: Downtown office vacancy

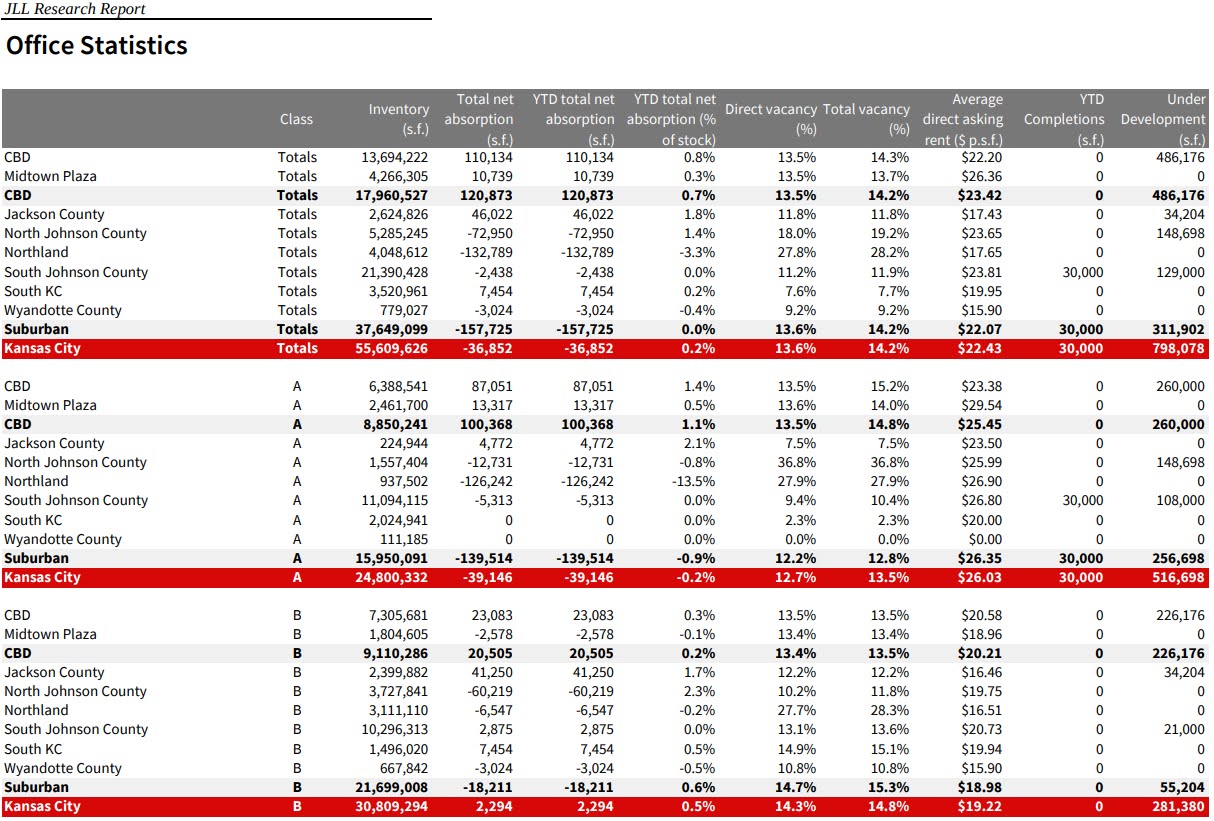

JLL's Q4/2020 report. Claims Downtown net absorption was positive for the year with suburbs negatively hit, they don't track Class C.

https://www.us.jll.com/content/dam/jll- ... 4-2020.pdf

Collier's report should come out next month, which tracks the most space.

https://www.us.jll.com/content/dam/jll- ... 4-2020.pdf

Collier's report should come out next month, which tracks the most space.

-

earthling

- Mark Twain Tower

- Posts: 8519

- Joined: Sun Sep 11, 2011 2:27 pm

- Location: milky way, orion arm

Re: Downtown office vacancy

KC metro ranked 7th for 'active market' according to this CBRE study...

https://www.cbre.us/research-and-report ... es-in-2020

https://www.cbre.us/research-and-report ... es-in-2020

Re: Downtown office vacancy

Always appreciate you sharing these numbers and reports!earthling wrote: ↑Tue Jan 26, 2021 10:15 am KC metro ranked 7th for 'active market' according to this CBRE study...

https://www.cbre.us/research-and-report ... es-in-2020

-

earthling

- Mark Twain Tower

- Posts: 8519

- Joined: Sun Sep 11, 2011 2:27 pm

- Location: milky way, orion arm

Re: Downtown office vacancy

According to CBRE, KC metro office market among strongest positions for Q4/2020, though all still significant negative absorption for entire year, including KC. But Q4 was relatively better in KC than rest of US.

http://cbre.vo.llnwd.net/grgservices/se ... 9edbcbceb6

http://cbre.vo.llnwd.net/grgservices/se ... 9edbcbceb6

-

earthling

- Mark Twain Tower

- Posts: 8519

- Joined: Sun Sep 11, 2011 2:27 pm

- Location: milky way, orion arm

Re: Downtown office vacancy

According to JLL, just before COVID about 8% of Fortune 500 company workers were WFH, 98% when COVID hit and they expect it to reduce to 20% by end of 2021.

Might be higher % of workers that stick with WFH or may not trend as quickly towards as much office only as many companies have invested so much in WFH processes/infrastructure, adjusting to it. A friend at Sun Life (with CC office) said they've planning most WFH globally anyway before COVID started, already cutting down office usage significantly and permanently. He's now permanently WFH with no dedicated desk and even before COVID rarely went to office. Most companies may not adapt mostly WFH long term but if 20%-30% of companies do, that could become a significant hit to office space usage long term as leases expire, which will take time. On the flipside, as office lease rates get cheaper, growing companies might take advantage of low rates and sign longer term leases at the lower rates. Recently, lease renewals that have occurred are typically shorter term leases on average.

Might be higher % of workers that stick with WFH or may not trend as quickly towards as much office only as many companies have invested so much in WFH processes/infrastructure, adjusting to it. A friend at Sun Life (with CC office) said they've planning most WFH globally anyway before COVID started, already cutting down office usage significantly and permanently. He's now permanently WFH with no dedicated desk and even before COVID rarely went to office. Most companies may not adapt mostly WFH long term but if 20%-30% of companies do, that could become a significant hit to office space usage long term as leases expire, which will take time. On the flipside, as office lease rates get cheaper, growing companies might take advantage of low rates and sign longer term leases at the lower rates. Recently, lease renewals that have occurred are typically shorter term leases on average.

- FangKC

- City Hall

- Posts: 18231

- Joined: Sat Jul 26, 2003 10:02 pm

- Location: Old Northeast -- Indian Mound

Re: Downtown office vacancy

What Happens When a City’s Largest Employer Goes ‘Work From Anywhere’

Salesforce positioned itself as a focal point of downtown San Francisco with its behemoth headquarters. Now it joins the list of tech companies de-emphasizing the office.

Salesforce positioned itself as a focal point of downtown San Francisco with its behemoth headquarters. Now it joins the list of tech companies de-emphasizing the office.

https://www.bloomberg.com/news/articles ... nt=citylab...

Now that metaphorical stature takes on a new dimension, with Salesforce.com Inc. — the anchor tenant of the 61-story building’s Class A office space — announcing a permanent “work from anywhere” policy that lets employees remain on remote or flexible schedules after the pandemic ends. As San Francisco’s largest private employer, the customer-management software giant is a heavy hitter on the list of companies with similar plans set to affect downtown office spaces, including Twitter, Facebook and Square, prompting tough questions about the vitality of the city’s core and overall economy.

“This is a much bigger urban workforce shift. It’s saying, tech doesn’t need to be anywhere,” said John King, the San Francisco Chronicle’s urban design critic. That shift applies to cities beyond the San Francisco Bay Area — including in Salesforce’s other offices worldwide — but it may hit America’s tech center especially hard. In the heart of the city that’s in the heart of the region sits a behemoth tower and adjacent transit center where the namesake company will now de-emphasize commutes. A structure that had taken on outsized presence in the urban landscape — literally and metaphorically — will shape-shift again.

...

- normalthings

- Mark Twain Tower

- Posts: 8018

- Joined: Mon Mar 30, 2015 9:52 pm

Re: Downtown office vacancy

3 of those companies had launched STL offices before covid and 2 wanted to do big plays in STL. It will be interesting to see what happens to tech back offices.

-

earthling

- Mark Twain Tower

- Posts: 8519

- Joined: Sun Sep 11, 2011 2:27 pm

- Location: milky way, orion arm

Re: Downtown office vacancy

If WFA/WFH momentum sticks permanently to some degree, downtown cores that shift to more residential could potentially offset this some, especially if many/most downtown residents have WFA/WFH jobs. That would help keep the streets busy with a daytime population, though not at same level given far more employees fit than residents in same size building. Would be surprising though if more than 30% hit to office space long term. Ugly situation for office industry if more than that. It might end up being a good thing that downtown KC has had more of a residential boom than office. We might see more Class B/C office buildings convert to residential.

And KC maybe already benefiting from WF Anywhere jobs being a cheaper city to live in that has most big city amenities. The labor force is returning quite a bit faster than jobs now even though KC jobs returning much better than US avg (and unusual considering labor force still much lower than last peak in other cities), which might mean that outsiders with WFA jobs are moving here. They aren't employed with a company with KC office yet are part of the labor force. Would be nice to see a specific study on that to determine if the case. Migration data for 2020 should be coming out end of March to April. That will give another indication but a dedicated study would be better.

The new KCI needs to build up non-stop destinations though for KC to become a notable WFA hub.

And KC maybe already benefiting from WF Anywhere jobs being a cheaper city to live in that has most big city amenities. The labor force is returning quite a bit faster than jobs now even though KC jobs returning much better than US avg (and unusual considering labor force still much lower than last peak in other cities), which might mean that outsiders with WFA jobs are moving here. They aren't employed with a company with KC office yet are part of the labor force. Would be nice to see a specific study on that to determine if the case. Migration data for 2020 should be coming out end of March to April. That will give another indication but a dedicated study would be better.

The new KCI needs to build up non-stop destinations though for KC to become a notable WFA hub.

-

earthling

- Mark Twain Tower

- Posts: 8519

- Joined: Sun Sep 11, 2011 2:27 pm

- Location: milky way, orion arm

Re: Downtown office vacancy

Colliers' national Q4/2020 report. They track the most space in KC and claim that downtown to Plaza nearly 400K negative absorption for year but only 7.5% vacancy (all classes), much better than US avg. Class A vacancy nearly 14%, worse than US avg and not great with W&R spec building coming next.

They combine urban core totals for 'downtown' in the national report, so Midtown/Plaza is included...

https://www.colliers.com/en/research/20 ... ook-report

They combine urban core totals for 'downtown' in the national report, so Midtown/Plaza is included...

https://www.colliers.com/en/research/20 ... ook-report

-

earthling

- Mark Twain Tower

- Posts: 8519

- Joined: Sun Sep 11, 2011 2:27 pm

- Location: milky way, orion arm

Re: Downtown office vacancy

Office conversions to residential happening beyond downtown given hit to office market and demand for housing. A few in Northland converting space to residential...

https://www.bizjournals.com/kansascity/ ... rsion.html

https://www.bizjournals.com/kansascity/ ... rsion.html

- beautyfromashes

- One Park Place

- Posts: 7290

- Joined: Mon Mar 21, 2005 11:04 am

Re: Downtown office vacancy

Makes a lot of sense. Take a property feeling decreased demand and turn it into a property that has rapidly increasing pricing.earthling wrote: ↑Thu Mar 25, 2021 10:24 am Office conversions to residential happening beyond downtown given hit to office market and demand for housing. A few in Northland converting space to residential...

https://www.bizjournals.com/kansascity/ ... rsion.html

-

earthling

- Mark Twain Tower

- Posts: 8519

- Joined: Sun Sep 11, 2011 2:27 pm

- Location: milky way, orion arm

Re: Downtown office vacancy

^Northland in particular has high office vacancy relative to rest of metro that so far is in pretty decent state considering (might change as leases expire over time)...

https://www.cbre.us/research-and-report ... ew-Q4-2020

https://www.us.jll.com/content/dam/jll- ... 4-2020.pdf

https://www.cbre.us/research-and-report ... ew-Q4-2020

https://www.us.jll.com/content/dam/jll- ... 4-2020.pdf

-

earthling

- Mark Twain Tower

- Posts: 8519

- Joined: Sun Sep 11, 2011 2:27 pm

- Location: milky way, orion arm

Re: Downtown office vacancy

Cushman's Q1/2021 report out...

Crown Center/Xroads taking a bigger hit than rest of downtown with 24% vacancy. Northland hardest hit in metro with whopping 32% vacancy. However JoCo most of the negative absorption within last quarter. Historically developers would like to see typically below 12% vacancy to consider spec building but driving factors are probably different now (such as lower interest rates and this possibly becoming a trend).

Cushman doesn't factor Class C space so other reports coming will show different results.

https://cw-gbl-gws-prod.azureedge.net/- ... dd8dd76e00

Crown Center/Xroads taking a bigger hit than rest of downtown with 24% vacancy. Northland hardest hit in metro with whopping 32% vacancy. However JoCo most of the negative absorption within last quarter. Historically developers would like to see typically below 12% vacancy to consider spec building but driving factors are probably different now (such as lower interest rates and this possibly becoming a trend).

Cushman doesn't factor Class C space so other reports coming will show different results.

https://cw-gbl-gws-prod.azureedge.net/- ... dd8dd76e00

-

earthling

- Mark Twain Tower

- Posts: 8519

- Joined: Sun Sep 11, 2011 2:27 pm

- Location: milky way, orion arm

Re: Downtown office vacancy

JLL Q1/2021 report. They track slightly more downtown space and slightly less suburban than Cushman, and perhaps different types of buildings. JLL says that Northland took biggest hit with negative absorption last Q and then NoJoCo. Says NoJoCo has highest vacancy rate in metro, while Cushman says Northland highest vacancy. Claims that downtown had more positive absorption across the board, moreso than Cushman. Because possibly different types of buildings they track, both not necessarily conflicting reports. Both saying Northland/NoJoCo struggling the most in metro last Q.

Colliers provides a larger perhaps more comprehensive picture but they haven't released even two quarters ago yet.

https://www.us.jll.com/content/dam/jll- ... s-city.pdf

Colliers provides a larger perhaps more comprehensive picture but they haven't released even two quarters ago yet.

https://www.us.jll.com/content/dam/jll- ... s-city.pdf

-

earthling

- Mark Twain Tower

- Posts: 8519

- Joined: Sun Sep 11, 2011 2:27 pm

- Location: milky way, orion arm

Re: Downtown office vacancy

CBRE Q1/2021. Unlike JLL, shows negative Class A absorption downtown. All three reports agree that Northland vacancy hard hit.

https://www.cbre.us/research-and-report ... ew-Q1-2021

https://www.cbre.us/research-and-report ... ew-Q1-2021

-

earthling

- Mark Twain Tower

- Posts: 8519

- Joined: Sun Sep 11, 2011 2:27 pm

- Location: milky way, orion arm

Re: Downtown office vacancy

Cushman National Q1 office report. Does not include Class C space.

US vacancy continues to get worse each quarter. Many larger markets are worse than US avg. KC metro is about same as US avg, also getting worse each quarter, going from 13.6% before pandemic impact hit to 16.4% last quarter. ATL, CHI, DFW, COL, HOU, MSP, PHX and a few others are over a not-so-good 20% vacancy. Might be a couple more years before the dust settles. What % of WFH sticks long term unknown too.

Small print ahead. Zoom in your browser or open report link below.

https://www.cushmanwakefield.com/en/uni ... at-reports

US vacancy continues to get worse each quarter. Many larger markets are worse than US avg. KC metro is about same as US avg, also getting worse each quarter, going from 13.6% before pandemic impact hit to 16.4% last quarter. ATL, CHI, DFW, COL, HOU, MSP, PHX and a few others are over a not-so-good 20% vacancy. Might be a couple more years before the dust settles. What % of WFH sticks long term unknown too.

Small print ahead. Zoom in your browser or open report link below.

https://www.cushmanwakefield.com/en/uni ... at-reports

-

earthling

- Mark Twain Tower

- Posts: 8519

- Joined: Sun Sep 11, 2011 2:27 pm

- Location: milky way, orion arm

Re: Downtown office vacancy

CBRE says KC metro's office using employment grew slightly through Q1, only one in Midwest while most of US declined...

-

earthling

- Mark Twain Tower

- Posts: 8519

- Joined: Sun Sep 11, 2011 2:27 pm

- Location: milky way, orion arm

Re: Downtown office vacancy

US Bank has about 2K employees in KC area and apparently plans some to still be full time remote and 'vast majority' to be hybrid. If even only 25% of local office using companies plan this, that would probably increase vacancy further as leases expire.

https://www.bizjournals.com/kansascity/ ... plans.html

Add to that the continuing trend to redesign office for hybrid workers, such as hotel cubes and other forms of no dedicated desks for rotating employees, which allows for leasing much less space...

https://www.bizjournals.com/kansascity/ ... esign.html

As mentioned, the potential upside long term for downtown might be more Class B/C buildings converted to residential and over time create shortage and justification for new office space, which would typically be Class A. The W&R building will be an interesting test, which is at this point a spec building.

And if this trend sticks nationally long term, I wonder if we'll start seeing office buildings sort of makeshifted into office/residential mix by floors. Applying tech to elevators/security would probably allow for some pretty oddball mixed-use mashups.

https://www.bizjournals.com/kansascity/ ... plans.html

Add to that the continuing trend to redesign office for hybrid workers, such as hotel cubes and other forms of no dedicated desks for rotating employees, which allows for leasing much less space...

https://www.bizjournals.com/kansascity/ ... esign.html

As mentioned, the potential upside long term for downtown might be more Class B/C buildings converted to residential and over time create shortage and justification for new office space, which would typically be Class A. The W&R building will be an interesting test, which is at this point a spec building.

And if this trend sticks nationally long term, I wonder if we'll start seeing office buildings sort of makeshifted into office/residential mix by floors. Applying tech to elevators/security would probably allow for some pretty oddball mixed-use mashups.